What Should Be Done To Kickstart Economic Growth Short Term And Sustain It Long Term?

What Should Be Done To Kickstart Economic Growth Short Term And Sustain It Long Term?

The United States economy has grown steadily but weakly since the 2008 financial meltdown. The history of past recoveries would suggest that the deeper the recession, the stronger the subsequent recovery will be. Why has this severe recession not recovered strongly this time around?

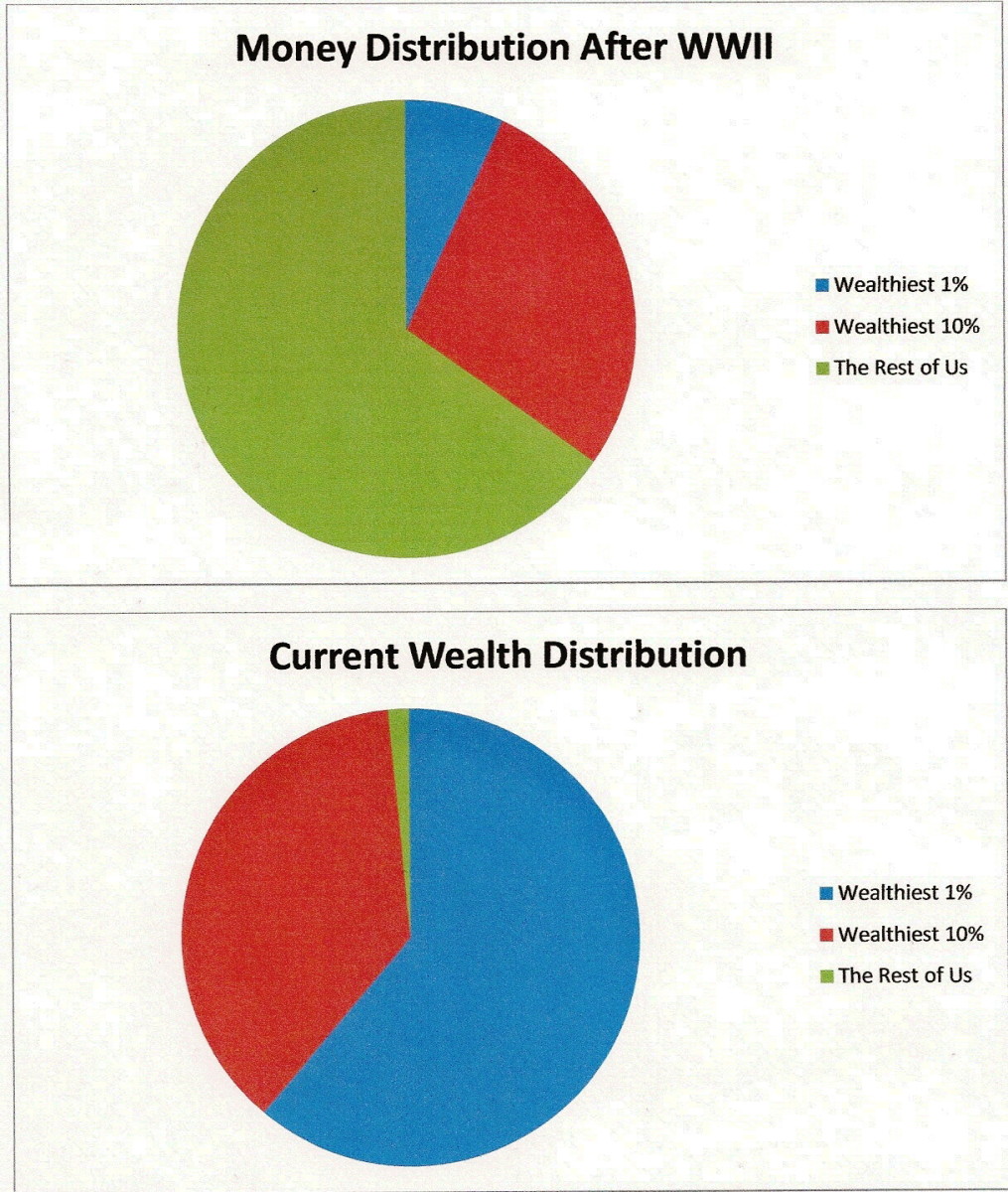

Conservative Republicans argue that increased government spending and regulation tightening are to blame. I argue that the primary cause is the huge and growing disparity in wealth and income between the wealthy and the lower economic classes.

Initially the slower growth was due to a moribund housing market that took at least three years to turn around. This market has been growing strongly for over a year now. The overall economy has been growing but is still in a quite weak recovery.

My view is that a tremendous amount of money is parked on the sidelines not being spent or invested by the wealthy and business. The upper 2% of the United States controls 90% of our wealth. They do not have the need to spend most of their wealth while the rest of the citizenry must spend virtually every dollar of their income.

Corporations are very skittish about spending because of the 2008 financial meltdown and the subsequent severe recession. They continually leave billions of dollars idle while cutting staff and keeping salaries low. None of this is illegal of course. We need governmental policies that will coax more money into the flow of the economy and into the hands of the people who need it most and must spend it.

I will examine four areas of policy action in which short or long term economic growth would be stimulated. These areas are, tax policy, investment incentives, minimum wage growth, and education spending. Finally I will pull all of these threads together and explain how they will combine to stimulate our economy now as well as ensuring a strong economy for the future.

The single largest contributor to the large and growing wealth and income gaps in the U.S. is the continual regression in our national income tax policies. This started during the Reagan Administration and hit its pinnacle with the 2001 Bush tax cuts.

Ronald Reagan came into the Presidency in 1981 as an ardent proponent of lower taxes and immediately pushed through a sharp tax cut. This was followed by tax reform legislation in 1986 that drastically cut rates while eliminating deductions. His economic advisors were strong believers in "supply side economics" which is an economic theory espoused by the economist Arthur Laffer. This theory states that cutting taxes will provide more funds for the private sector to invest with. Economic activity is thus increased which in turn increases profits. Eventually this economic growth will trickle down to workers whose net income will increase due to higher wages and an expanded job base. Or so the theory goes.

Economic activity did increase in the 1980's but income tax rates at their highest were at 70% prior to the Reagan cuts. These rates were stifling economic investment. The Bush tax cuts of 2001 put supply side economics on steroids. As with steroid use, extreme regressive tax cutting has proven to be destructive to the American economic body in the longer run. Economic activity is now being restrained because the upper 2% hold the bulk of the American wealth. They will never be able to spend more than a fraction of that wealth. Therefore economic activity will be extremely limited.

I would have allowed all of the Bush tax cuts to expire but political necessities caused President Obama to limit these expirations to incomes above one million dollars. Ideally I would have raised these higher income tax rates while letting the rest expire. The higher rates on those with lower incomes is nominal while the rise in rates on the wealthy would have netted huge amounts of funds. Thus our budget would have plummeted while also freeing up funds for social programs for the poor. This would have stimulated economic activity because the poor must spend all of this additional assistance. The rich would be without a fraction of their previously idle wealth.

A more progressive income tax system is not the only alternative to stimulating our weak economy. Investment incentives are positive ways for business and the wealthy to benefit themselves while also getting their hoard of funds off the sidelines and circulating through the economy. I have a three pronged approach.

The first is to finally create and finance the often proposed Infrastructure Bank. This bank will be a government and private sector collaboration. There have been several variations proposed regarding this idea. The basic plan would be for the federal government to borrow a large amount of funds. Fifty to sixty billion dollars are the common levels advocated for. This pool of money would reinforce and leverage private funds to finance proposed and approved public infrastructure projects.

This new bank would be a separate entity run by a Board of Directors from both the public and private sector. Ideally the public sector would provide the Chairman since it is a bank formed for the benefit principally of the public. Of course extreme benefits would also accrue to the private sector by way of large profits and much more effective and reliable infrastructure. This bank would combine two vast national needs. The need for investment to create jobs and the need to repair our crumbling infrastructure.

The second area that I feel we should address is the creation of new investment tax credits. These credits would encourage business to invest their massive pool of idle funds into corporate projects that will stimulate our economy and thus create jobs. These credits have the same aim as changing our income tax system into a more progressive one. The exception is that these taxes will benefit business and the wealthy if they take advantage of them.

The bottom line on both of these ideas is to remove these billions of dollars out of limbo and getting them invested into our economy stimulating growth and increasing employment throughout the United States.

Thirdly, I propose a new Jobs Credit. Any company that hires staff above their previous levels and keeps them there or above for at least three years would receive a tax credit. This credit would be for a percentage of the salaries of those hires. Each company would receive part of this amount each year for this three year span. The credit would end if these new hires were terminated at any time up to the three year mark. This will obviously increase employment steadily and hopefully for the long term as the economy strengthens.

I will now turn to our minimum wage laws. The minimum wage has remained relatively stagnant for the past 25 years compared to our nation's inflation rates. It is about time that we had a significant increase in our national minimum wage rate both for economic fairness and economic stimulus.

The people that currently work for the minimum wage or slightly higher are living below subsistence levels. Therefore 100% of any total increase in wages for these workers will have to be circulated right back into the economy. The economy will grow stronger increasing revenues for business even though their wage expenses will grow slightly.

Henry Ford knew the wisdom of this action going back to the early days of his company. He raised the daily wage of his auto workers from $2.38 a day to $5.00 a day in 1914. Other corporate titans howled and ridiculed him predicting his company's rapid demise. Ford knew that by making his workers more prosperous he had created thousands of new customers. He also knew that this would create far better morale in his workforce which meant much better productivity and quality from his workers.

The sale of Ford's cars soared after this wage increase and was sustained for many years. The same outcome can be expected for the United States economy if our minimum wage is increased to $10.10 an hour as the Obama Administration has proposed.

Finally, I believe we need a serious increase in education spending both for employment retraining and for improved higher education funding to sustain a first class workforce for the future.

Most states already have some sort of employment retraining program. Unfortunately the vast majority of these programs are woefully inadequate to the size and nature of our current long term unemployment climate.

I propose a federal grant program for employment retraining. Each state would be allocated a block of funds based on the size of their unemployed workforce and the scope of the retraining that the state proposes to utilize. This program would turn existing retraining programs into more substantive and effective ones because of proper funding. This would put a serious dent into long term unemployment rates all around the country.

A second area of educational policy that our federal government should take up is the expansion and restructuring of funding for college loans and grants. Our economy has evolved from largely manufacturing into more of a high technology economy. This trend will only accelerate. A college level education is vital for the filling of jobs in this higher level economy.

Many potential students currently cannot afford to attend college. Many others assume crippling student loans so they can accomplish their goal of attaining a college degree. I propose a massive expansion of federal grants for college students. I also propose a new student loan program not run by separate for profit financial institutions.

These financial institutions have recently failed to provide significant interest rate relief to these struggling students. Profits have ruled over the goal of aiding students. This program should be run by the federal government with the emphasis on debt relief and not profit.

In turn, student must be held responsible for diligent studies and not for wasting time and money. Therefore I believe that students who fail their courses should be required to repay all or most of their grant money and pay a market interest rate on their remaining student loans.

Finally I believe a program should be instituted whereby graduated students may perform national or local civic jobs which will satisfy part or all of their student loans depending on the nature and scope of those duties. This program would ease the financial burden on these students, give them valuable professional experience, and provide society with affordable educated labor to aid in the administering of many of the duties necessary to that community.

The bottom line solutions needed to kick start our economy out of its anemic recovery into a robust one clearly must center around coaxing corporate and upper class money off the sidelines into the circulation of our economy. Our tax policies since the Reagan Administration have become steadily regressive resulting in a huge disparity between the wealth and income of the wealthy and the lower classes.

The United States needs to raise income rates especially on the wealthy to narrow the wealth gap. This would not only help to balance the budget but it would free up money to sustain and expand desperately needed social programs for the poor. These funds would all be spent immediately due to necessity stimulating the economy.

Infrastructure spending, investment tax credits, and a new Jobs Credit would also help to bring the surplus of corporate money into circulation throughout the economy further promoting growth. A significant minimum wage hike would further stimulate the economy immediately while bringing millions of Americans out of poverty or nearly so.

Employment retraining and increased higher education investment will help to strengthen our economy as well as sustaining its growth. This will happen because long term unemployment will decrease and the workforce's long term educational acumen will increase.

It has always struck me that the conservative Republican line of constant and drastic budget cutting was always "penny wise and pound foolish". Yes, we certainly need to sharply cut our huge budget deficit. Eventually it will begin to strangle our economy if left alone and allowed to grow. The question is what type of cuts are effective and which make no sense.

Cutting social programs and education spending are pound foolish because they will weaken the economy short term and long term respectively. That is pound foolish. Actually, increasing taxes on the wealthier among us will help us to expand these programs and further stimulate our economy.

The fact of the matter is that wealth has become so skewed to the upper 2% of this country that much needed funds are being held out of our economy causing its stagnation. Cutting our national budgetary belts would exacerbate this problem not help it. We need more common sense observation of our economic options instead of these "knee jerk" reflexive budget cutting tendencies.

The economic options that I have outlined in this Hub will bring more balance into our economy as well as giving it the fuel to grow robustly. The economic growth that my proposals would engender will grow our tax revenue base so strongly that our deficit would rapidly decline. This economic strength would build upon itself and I believe we would soon find ourselves in a position similar to the surpluses of the late 1990's.

We need to urge our lawmakers to pursue more sensible economic paths and not succumb to the "sky is falling" deficit panic nonsense that the Tea Party and their acolytes cry for. Our future as a prosperous and fair nation are at stake.

Do we want a country of simply a small wealthy class and a largely poor one? I do not think so. Besides, that condition would ruin our national economy and destroy all of us. Both rich and poor. We cannot and must not let that happen. I believe my proposals would avert that scenario and I hope our political leaders will take them up and bring common sense back to economic policy in the United States.